關於黃金

實際擁有真正的黃金,在今日是一個首要目標,可以幫助完全跳脫複雜的投資組合。黃金提供我們免於受到貨幣貶值影響的保護,例如由政府主導為因應進出口貿易而所干預貨幣彈性升值或貶值。然而,黃金並不局限於任何一種貨幣或國家,而是建立在全球供需基礎的自身價值之上。上漲的黃金價格通常可作為一個“防盜警報”,警告我們,通貨膨脹在竊取我們的銀行帳戶,我們的台幣購買力正漸漸失去。

實際擁有真正的黃金,在今日是一個首要目標,可以幫助完全跳脫複雜的投資組合。黃金提供我們免於受到貨幣貶值影響的保護,例如由政府主導為因應進出口貿易而所干預貨幣彈性升值或貶值。然而,黃金並不局限於任何一種貨幣或國家,而是建立在全球供需基礎的自身價值之上。上漲的黃金價格通常可作為一個“防盜警報”,警告我們,通貨膨脹在竊取我們的銀行帳戶,我們的台幣購買力正漸漸失去。

Gold is an everlasting source of value, offering those with foresight a secure passage through the most uncertain and turbulent times in the history. Possessing physical gold in your investment portfolios ensures resilience against the repercussions of devastating economic events, including stock market crashes and inflation. For some of us, incorporating physical gold to diversify asset allocation has become common sense in response to the prevailing uncertainty in today's world.

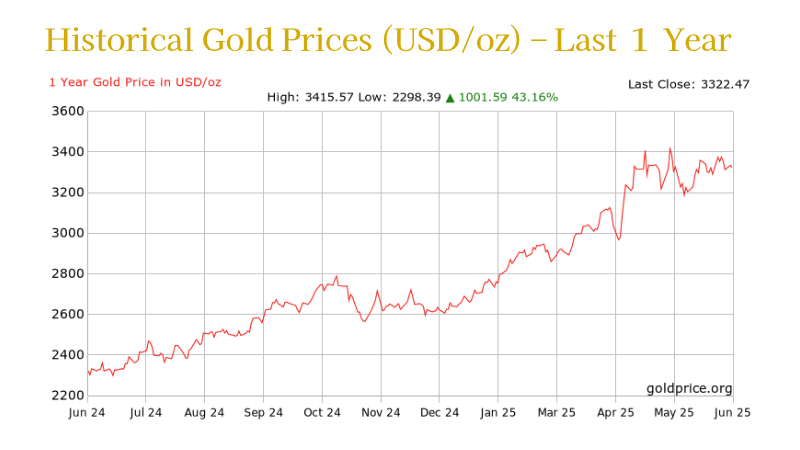

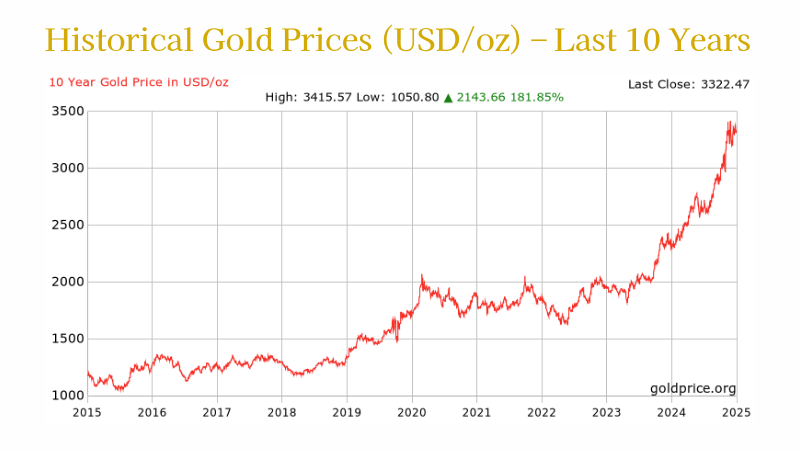

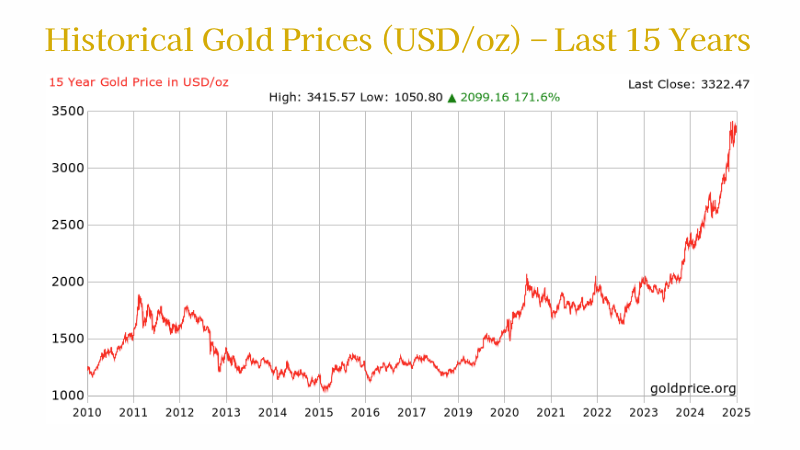

In the past decade, stats show that gold has outperformed the Dow Jones Industrial Average, the S&P 500 Index, and the Nasdaq Index, leading Mark Bristow, the Chief Executive of Barrick Gold Corp., to dub this period "a decade of free money”. Gold is viewed as a robust and stable strategy sought by everyone to safeguard the advantages of their long-term savings.

自早期文明以來,黃金一直是在世界各地許多文化當中,扮演著美麗,財富,不朽和權力的最終象徵。甚至在它被用作貨幣之前,黃金仍是重要的。 世界的統治者和精英將它視為崇拜的對象,並創造了神殿,人像,各種船隻和珠寶。甚至到了今日,如同古代一樣,黃金的內在價值具有相同的普遍吸引力。黃金的美麗,稀有,獨特,以及它可以被融化塑造成任何的形式來保存,使它自然成為一個交易媒介。

Shortly after being minted into standardized coins, gold and silver replaced the barter system. Dating back to 560 BCE, gold was already recognized and utilized as a form of currency.

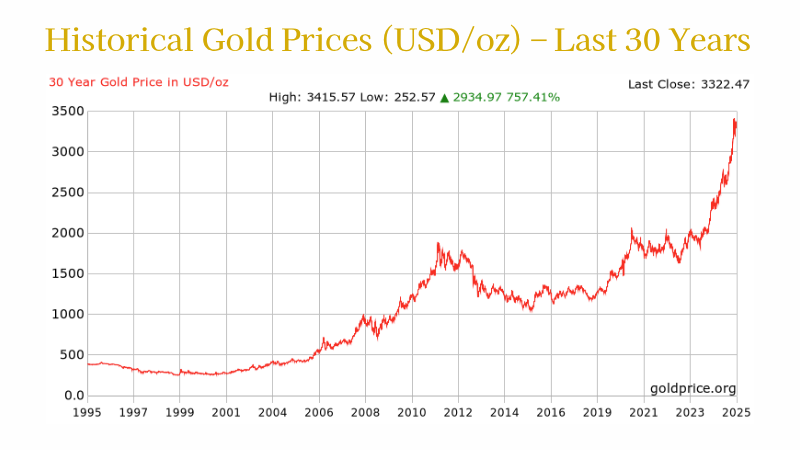

On April 5 1933, President Franklin D. Roosevelt issued Executive Order 6102, forbidding the hoarding of gold and restricting individuals from owning more than 5 ounces. Those holding huge amounts of gold were compelled to sell it to the government at a rate of $20.67 per ounce.

Soon after this compulsory sale, the international price of gold, as set by the US Department of the Treasury, increased to $35 per ounce. This resulted in a 41% devaluation of the U.S. dollar. (which had just been enforced upon citizens in exchange for their gold)

It is estimated that only 1% of the coins existing at that time survived after widespread melting. The government maintained the price of gold at $35 per ounce until August 15, 1971, when President Richard Nixon announced the end of the gold standard, discontinuing the fixed convertibility of the U.S. dollar into a specific amount of gold.